The borough council confirmed its budget plans on Monday (15th February) evening.

Tax rates are determined based on the value of your property on the 1st April 1991.

The borough council, as well as the county council and the police and crime commissioner each put forward their share of council tax.

The full charges for each band for the 2020-21 financial year are:

- Band A (properties valued up to £40,000) - £1,310.33 - an increase of £48.03 per year

- Band B (properties valued between £40,001 to £52,000) - £1,528.72 - an increase of £56.04 per year

- Band C (properties valued between £52,001 to £68,000) - £1,747.11 - an increase of £64.03 per year

- Band D (properties valued between £68,001 to £88,000) - £1,965.50 - an increase of £72.05 per year

- Band E (properties valued between £88,001 to £120,000) - £2,402.28 - an increase of £88.06 per year

- Band F (properties valued between £120,001 to £160,000) - £2,839.06 - an increase of £104.08 per year

- Band G (properties valued between £160,001 to £320,000) - £3,275.83 - an increase of £120.08 per year

- Band H ((properties valued at more than £320,000) - £3,931.00 - an increase of £144.10 per year

National Secondary School Place Offer Day

National Secondary School Place Offer Day

Flooding hits after days of heavy rain

Flooding hits after days of heavy rain

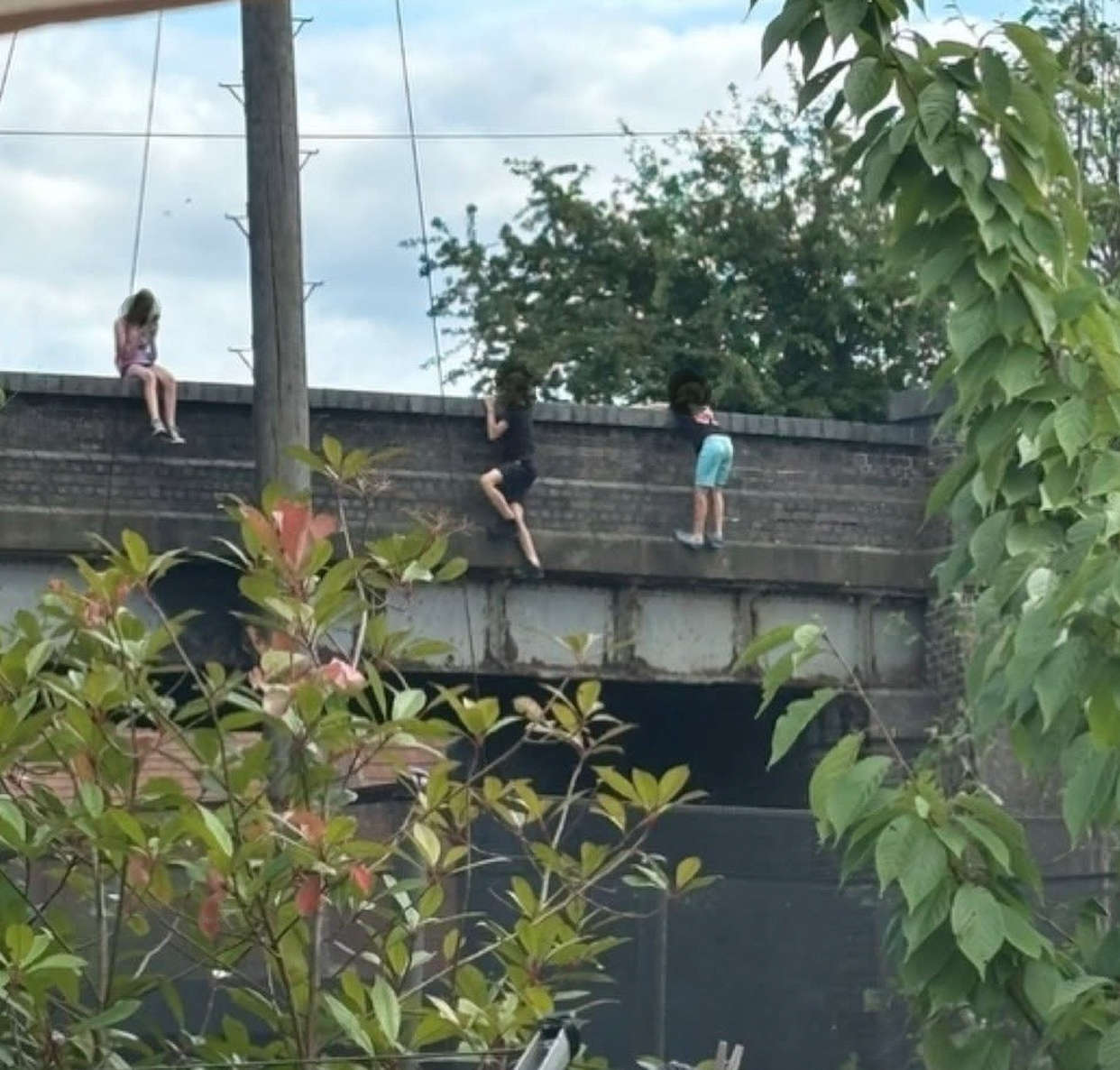

Children seeing dangling from Leicestershire railway bridge

Children seeing dangling from Leicestershire railway bridge

Sink hole that has closed Loughborough road

Sink hole that has closed Loughborough road

Emergency animal rescues by firefighters in Leicestershire

Emergency animal rescues by firefighters in Leicestershire

National offer day - what it means for you

National offer day - what it means for you

Parents being urged to help kids learning to drive

Parents being urged to help kids learning to drive